Sophomore Rocks the Stocks

May 22, 2015

Every year, the Economics classes of HBHS take on the Stock Market Simulation project. The project is meant to provide students with a basic understanding of the stock market, which can be applied when looking to invest in stocks.

Katie Pine, an economics teacher, advises that “[Students should] reduce risk and remain diversified so the stock portfolio doesn’t crumble”. Although usually this is a wise path to pursue, a student in Pine’s 1st period economics class took a different route to success.

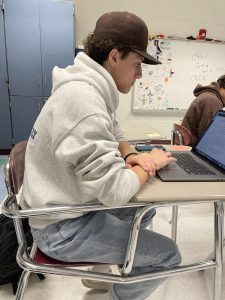

This year, one of Pine’s students broke the record for highest overall profits. The student, Nick Hinchliffe ‘17, accumulated a total sum of $238,106.89 on the simulation. Pine commented that “Nick doubled [his] money and then some.”

By buying-up penny stocks, which are known for their high-risk attributes, Hinchliffe received a 100+% rate of return on the project where most students aim to get a 3% rate of return and when 10% rates are considered to be very good.

“Students who are very interested [those who really get into it] spend much of their own time monitoring the stocks,” said Pine. In fact, this is often the distinguishing factor between low-and high-earners–dedication to the market, rather than just to the project.

For those investing in the stock market right now, the average annual return for the S&P 500, which is comprised of large U.S. companies, has been about 10.1% since 1926. Inflation, over the same period of time has averaged 2.9%; meaning a net return on your investment in an index of large company equities averaged 7.2% annually since 1926. And while we all may aspire to the returns enjoyed by Hinchliffe’s risky investment in penny stocks, most of us would be delighted with an annual return of 7.2% in today’s environment.

![Steven Crooks grades a lab from his AP Physics 1 class. He is a new teacher, but already helping his students succeed with his grading philosophies and policies. “I want to see the thought process [in their work],” said Crooks.](https://cavchronline.com/wp-content/uploads/2024/01/Grading-Philosophies-300x225.jpg)

![Steven Crooks grades a lab from his AP Physics 1 class. He is a new teacher, but already helping his students succeed with his grading philosophies and policies. “I want to see the thought process [in their work],” said Crooks.](https://cavchronline.com/wp-content/uploads/2024/01/Grading-Philosophies-600x450.jpg)