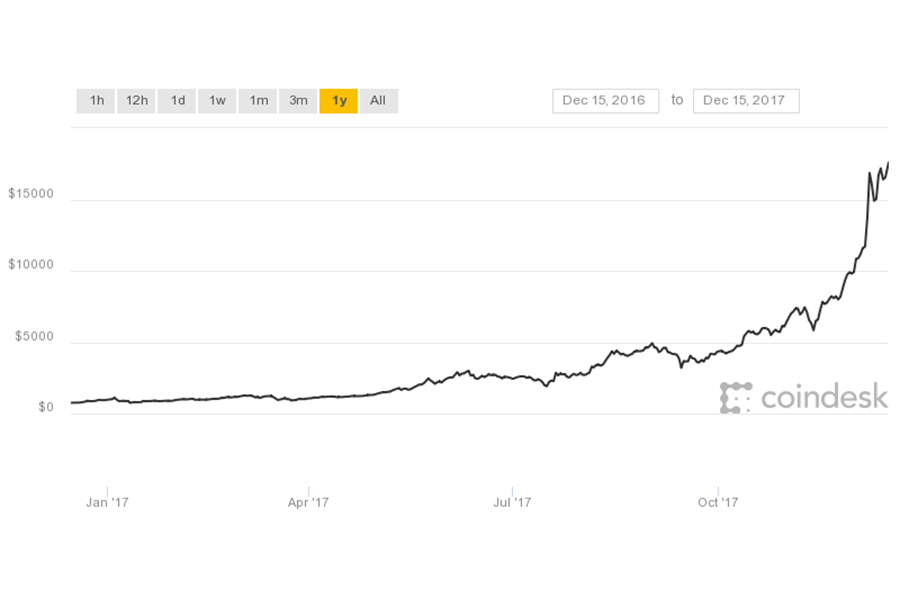

Quite a bit of coin!

This graph shows the increase in value of one Bitcoin over the entire year, from December of 2016 to December of 2017.

January 3, 2018

Bitcoins have gone through several unusual, exciting and potentially concerning developments rapidly over the past month. In the beginning of November, the price of an individual BTC (Bitcoin) was hovering around $6000-$7000. However, during the last week of November, the price reached $10000 for the first time. That’s quite a bit of coin, and a lot more exciting than the stock market to boot. But what the heck are Bitcoins?

Bitcoins are a form of cryptocurrency developed by an anonymous individual or group of individuals using the name Satoshi Nakamoto in 2009, building off of the concept of cryptocurrency which originated with Wei Dai in 1998. Cryptocurrencies provide, among other things, a secure system of information exchange and transaction. Despite Bitcoins being such a popular cryptocurrency with such seemingly easy profits associated with it, many people still don’t know what they are or only heard about them in passing. Cody Gagnon ‘18 is one of these people. Some Hollis-Brookline students were aware of the existence of currencies like Bitcoin, such as Christian Cenci ‘19. He invested a small amount into Bitcoin in the beginning of the year and profited $20 or so off of the amount he invested.

While the ideas have been around for a long time, their popularity has taken a while to develop. For example, one year ago, the price of a Bitcoin was about $700. Compare that to the $17,000 which it hit recently. Sounds like easy money, right? Or is it too good to be true? Here are some points to consider:

- They don’t exist! At least, not physically – Since cryptocurrencies are by nature virtual objects; they lack a physical form like cash does.

- Good: The lack of a physical form to have to transfer means that transactions using Bitcoins are relatively convenient compared to cash, at least without banks or other third parties becoming involved.

- Bad: This means that if the data about a Bitcoin wallet is lost (corrupted data, drives crashing, etc.), those coins are lost forever.

- Their prices. Are so. Volatile – As mentioned in the opening paragraph, the price of a Bitcoin (and other cryptocurrencies) can change a lot over a short amount of time. This is mostly due to the decentralised nature of Bitcoins, causing changes in prices to be magnified greatly. To see for yourself, try visiting the BPI (Bitcoin Price Index) on Coindesk.

- Good: $700 to $10000 is a ridiculous return on investment over a year.

- Bad: Try visiting the BPI and click the twelve hour, or even the one week setting for the timescale. See how much the value of one Bitcoin changes? Terrifying.

- Lack of faith – Many companies will refuse to accept Bitcoins and other cryptocurrencies. Understandable, especially considering the other points on this list.

- Good: This is something that could change, depending on how people’s usage of Bitcoin changes. Since it’s not an inherent issue with cryptocurrencies themselves (unlike the lack of a physical form), it’s less of an issue with the currencies and more of an issue with their popularity.

- Bad: What’s the point of spending energy, money and time on cryptocurrencies if it’s impossible to buy, say, a hamburger with it? A currency is only useful if people use it.

- Shady business – While not an issue depending on how it’s used, cryptocurrencies are very easy to use for criminal activities, owing to their anonymity and, again, decentralised nature.

- Good: So long as they aren’t used for illegal activities, this isn’t an issue. Again, like the last point, this isn’t an issue with cryptocurrencies themselves, it’s an issue with how people have used it.

- Bad: If they are used for criminal activities, there are potential punishments. For example, Ross Ulbricht, a man who created an online drug market called Silk Road, was sentenced to life without parole for his actions.

- Space-age Space Heater – Bitcoin mining uses a huge amount of energy, by design.

- Good: This makes sure people need to put in a decent amount of work to be rewarded. If Bitcoins were easy to get, they’d be worthless. However, cryptocurrencies other than Bitcoin use other designs to generate new instances of the currency, such as proof of stake. These are less energy-intensive and some platforms using them have gradually grown in use. Also, some people have even heated their homes with their Bitcoin mining setups. This is similar to another concept known as a data furnace.

- Bad: On top of the hazards posed by massive amounts of heat being released by a mining setup, it’s possible to lose money mining Bitcoins if the cost of electricity isn’t made up for by the Bitcoins produced.